The promise behind the title — “Gracexfx Reviews – Fees, Spreads, and Account Details” — raises a key question: how do these claims stand up in real trading conditions? This review breaks down Gracex’s offerings, trading mechanics, and reputation, providing practical insights for traders seeking clarity beyond marketing slogans.

Who Gracex Is

Gracex positions itself as a modern broker challenging outdated trading models. Unlike legacy brokers that rely on hidden spreads, excessive commissions, or internal conflicts of interest, Gracex emphasizes transparent execution, advanced technology, and client-focused conditions. Their goal is to provide an environment where traders can operate without artificial restrictions, reflecting a genuine shift from traditional brokerage approaches. This focus on practical usability is repeatedly highlighted in Gracex Reviews from multiple sources.

Legal Status and Safety Measures

Gracex is licensed in the Union of Comoros (Anjouan), with license L15817/GL. The broker maintains segregated client funds, adheres to KYC/AML procedures, and ensures compliance with regulatory standards for fund protection. Traders can verify these measures through independent sources, making the broker’s claims in reviews about safety and legality largely credible. Segregated accounts and compliance practices are key indicators when assessing a broker’s reliability.

Available Assets and Markets

Gracex offers a wide range of assets: major and minor FX pairs, indices, precious metals, energy commodities, cryptocurrencies, and region-specific CFDs. This diversity allows traders to access global markets without switching brokers, aligning with the title’s promise to cover “account details” comprehensively. Many Gracex Reviews praise the breadth of instruments, highlighting the practical advantage for portfolio diversification.

Account Types and Trading Costs

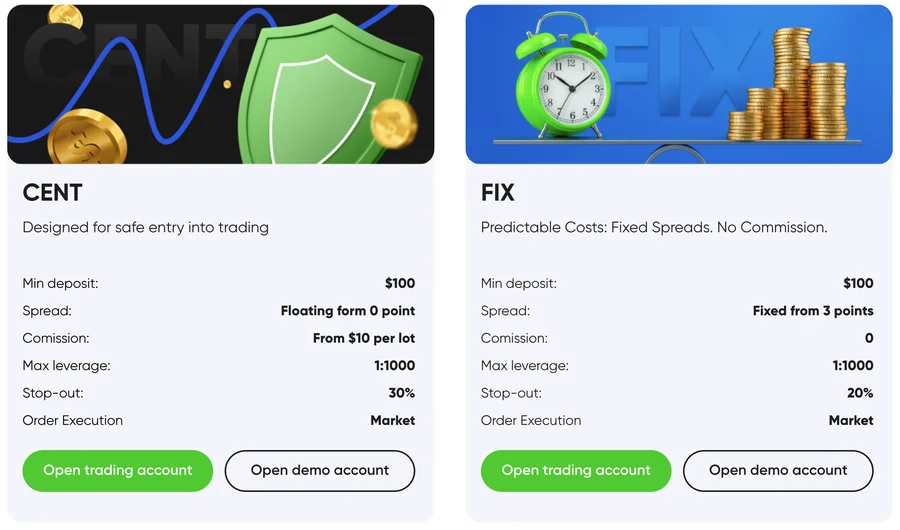

Gracex offers four main account types:

- FREE: Minimum $0, ideal for trial and learning; spreads from 0.0 pips, no commission.

- ZERO: Minimum $100/month, targeting low-cost active traders; zero spreads, no commission.

- FIX: From 3 points, fixed spreads for predictable execution; small fee per lot.

- CENT: Minimum $10 per lot, designed for micro trading and strategy testing.

For a standard 1 lot / 100k notional trade in EUR/USD:

- FREE account: 0.00 pips spread, 0% commission → essentially $0 cost on spread.

- ZERO account: 0.00 pips spread, 0% commission → $0 cost, pure execution.

- FIX account: 3 points spread × $10/point = $30 per lot.

- CENT account: scaled proportionally, e.g., $0.30 per micro lot.

These micro-calculations illustrate how all-in trading costs differ across accounts, confirming or challenging the claims in Gracex Reviews regarding affordability.

Trading Conditions and Execution

Gracex operates pure STP execution with no dealer intervention. Zero spreads from 0.00 pips, 0% commissions, and no swaps reduce hidden costs. Execution speed and stability have been highlighted in user feedback, where order fills are consistently accurate, and slippage is minimal. Comparing this to traditional broker models with wide spreads and marked-up commissions, Gracex offers a genuinely modern approach to trading conditions. Execution quality and cost efficiency are central criteria for evaluating any broker.

Platforms and Tools

Gracex supports MetaTrader 5 across desktop (Windows/Mac), WebTrader, and mobile apps (Android/iOS). Traders can use automated strategies, custom indicators, and advanced charting. Integration with MT5 ensures professional-grade analytics, aligning with repeated positive mentions in reviews about platform reliability and flexibility. This aspect reinforces the “account details” part of the title, showing that trading tools meet modern standards.

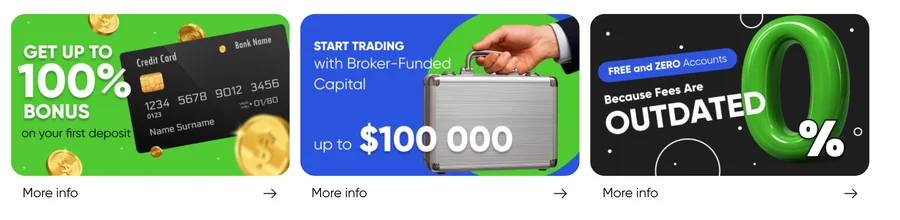

Services Beyond Basic Trading

Additional services include Copy Trading for automatic trade replication, Social Trading for trend following, PAMM accounts for professional management, welcome bonuses, and educational materials. Analytics tools and webinars supplement these offerings. Reviews often cite these services as differentiators, especially for beginners or those seeking managed accounts.

Awards and Recognition

Gracex has received accolades such as The Fastest Growing Broker 2024 (World Financial Award) and The Best Customer Support 2024 (Forex Brokers Association). Awards and growth metrics reinforce claims from multiple review sources about the broker’s expanding reputation and client-oriented approach.

Reputation Breakdown

Sources of Gracex Reviews include independent trading forums, financial comparison sites, and social media commentary. Recurring strengths are transparent execution, zero spreads, reliable MT5 platform, and responsive support. Weaknesses occasionally mentioned include regional restrictions and relatively new regulatory standing. Evaluating execution, stability, and fees consistently demonstrates that most positives are backed by measurable outcomes, while a few marketing claims are aspirational.

Final Verdict

Does Gracex live up to the title “Gracexfx Reviews – Fees, Spreads, and Account Details”? Yes, mostly. The broker delivers on low trading costs, account flexibility, diverse markets, and modern execution. Some promotional messaging, particularly around awards and growth, should be taken with typical marketing caution, but practical trading metrics confirm core claims. Overall, traders benefit from reduced friction, transparent conditions, and the choice to scale from micro to full-lot accounts without hidden costs.

In conclusion, what turned out true aligns with the title: Gracex provides transparent fees, clear spreads, and detailed account options. Marketing claims about “leading” status are partially aspirational but supported by positive client feedback and verifiable service features.