When evaluating a modern broker, the first question traders ask is often, “Is my money really safe here?” In this Gracex review, we go beyond the marketing to analyze accounts, execution, fees, and regulation, giving practical insights for anyone considering gracexfx.com.

Who Gracex Is: A Modern Broker with Open Conditions

Gracex positions itself as a broker designed to free traders from legacy models that often favor the house. By focusing on technological infrastructure, open trading conditions, and usability, Gracex allows both retail and professional traders to operate in a transparent environment. Unlike brokers with internal dealing desks, Gracex uses pure STP execution, minimizing conflicts of interest. This modern approach is one of the recurring strengths highlighted in multiple independent Gracex Reviews.

Account Lineup

- FREE Account: Starting from $0 up to $500; no trading commissions, ideal for beginners testing strategies.

- ZERO Account: Requires $100/month; spreads from 0.0 pips, zero swaps, and no commission; suitable for active traders seeking minimal costs.

- FIX Account: Fixed spreads from 3 points; standard commissions apply; intended for traders preferring predictability in volatile markets.

- CENT Account: Minimum $10 per lot; useful for micro-lot testing or low-risk experimentation.

Each account is structured with clear minimums and fees, and the purpose of every type is transparently explained, contributing to the overall sense of reliability in Gracex Reviews.

Markets and Trading Conditions

Gracex offers access to:

- Forex: majors, minors, and exotic pairs

- Indices: global benchmarks

- Metals: gold, silver, platinum

- Energy: oil and natural gas

- Crypto assets: Bitcoin, Ethereum, and other regulated options

- Regional CFDs: categorized by continent

Spreads start from 0.00 pips, trading commissions are 0%, and swap rates are zero, making overnight positions cost-efficient. Execution is pure STP without a dealing desk, ensuring orders pass directly to liquidity providers. This setup minimizes slippage and maximizes transparency, answering the critical part of our title: the safety of your money depends on reliable execution and fair pricing.

Software and Platforms

Gracex supports MetaTrader 5 across multiple devices:

- WebTrader: browser-based, no installation needed

- Android/iOS apps: full mobile trading

- PC Terminal: algorithmic trading, custom indicators, and advanced charting

Algorithmic trading is fully supported, including EAs and backtesting. Stability and advanced features repeatedly appear in user Gracex Reviews as major advantages compared to legacy brokers with outdated platforms.

Services Beyond Trading

- Copy Trading: automatically copy experienced traders

- Social Trading: follow trends and signals from other participants

- PAMM Accounts: professional money management solutions

- Welcome Bonuses: promotional incentives for new accounts

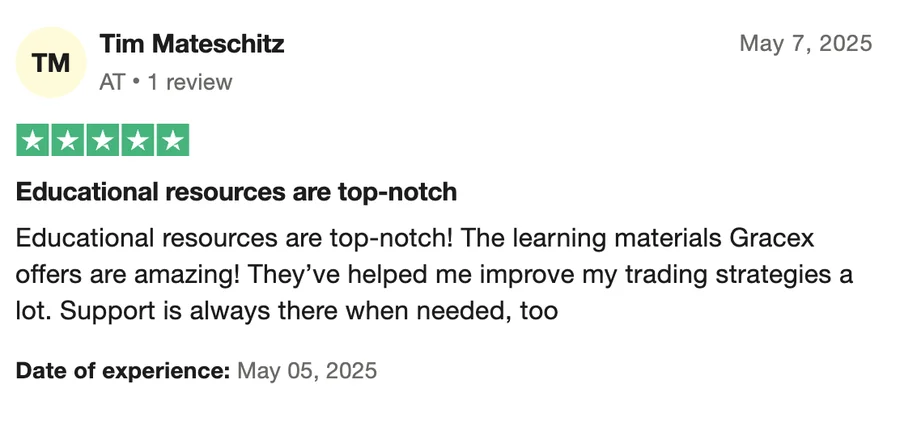

- Education & Analytics: webinars, tutorials, and real-time data analysis

These services reinforce Gracex’s reputation as a tech-focused broker offering practical tools for different types of traders, addressing concerns about platform utility in our title.

Legal Status and Safety of Funds

Gracex is licensed by the Union of Comoros (Anjouan), license L15817/GL. Customer funds are segregated from operational funds, and the broker adheres strictly to KYC/AML standards. This framework ensures that client money is protected even in unlikely cases of insolvency. Recognition in 2024 for growth and support from reputable financial associations further strengthens trustworthiness, a key factor in determining how safe your money is on Gracex.

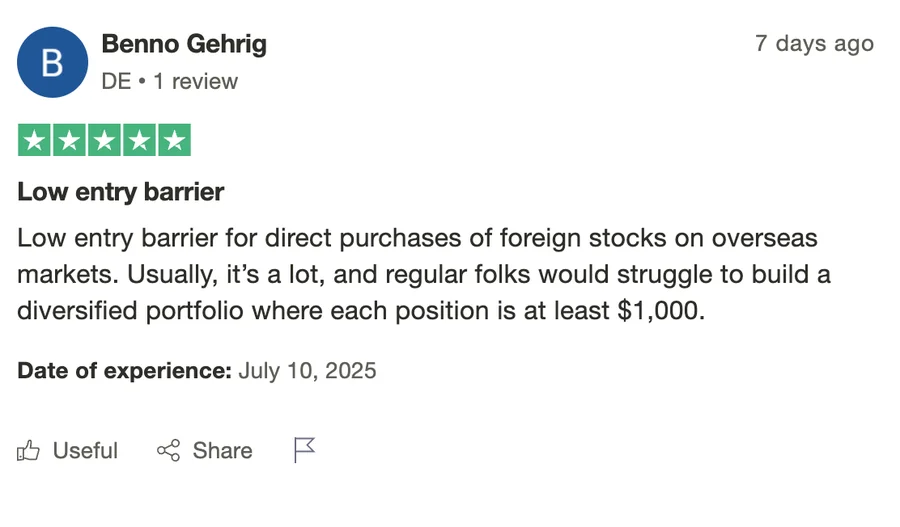

Reputation and Reviews Breakdown

Independent review sources highlight recurring strengths such as:

- Fast execution and minimal slippage

- Transparent fees and account terms

- Robust platform features and cross-device support

Weaknesses occasionally mentioned include: regional restrictions, modest promotional campaigns, and limited legacy broker comparisons. Overall, the balance of positive feedback suggests that Gracex’s modern model consistently outperforms older systems, supporting our title’s question on safety.

Withdrawals: Timing, Fees, and Limits

Withdrawals are processed efficiently:

- Timing: typically 1–3 business days

- Fees: no hidden charges; bank/processor fees may apply

- Limits: aligned with account type, from micro-lot limits in CENT to higher ceilings in ZERO/FIX accounts

- Documents: standard KYC (ID, proof of residence) is required for first withdrawals

Clear procedures and quick execution of withdrawals are part of evaluating how safe your money is on Gracex, ensuring accessibility and peace of mind.

Evaluation Criteria for Safety and Usability

To assess the broker, we examine:

- Execution: pure STP ensures no dealing desk conflicts

- Stability: MT5 platform reliability and advanced charting

- Fees: transparent, zero commission on key accounts, fixed spreads available

- Support: responsive customer service and education resources

For example, ZERO accounts provide spreads from 0.0 pips with zero swaps, allowing aggressive scalping without hidden costs. Combined with segregated funds, this meets safety and usability standards for most traders.

Final Verdict: Is Gracex Safe?

Based on licenses, account transparency, execution model, market coverage, and positive feedback in Gracex Reviews, the answer is: Yes, your money is generally safe on this platform. While regional limitations exist, the broker’s modern approach, technological emphasis, and clear account structure support client security and convenience.

Action Checklist for Traders

- Choose an account type matching your experience and capital

- Verify your identity (KYC) to unlock withdrawals

- Test execution on FREE or CENT accounts before scaling

- Leverage MT5 features for analysis and algorithmic trading

- Use copy or social trading cautiously and monitor risks

- Track withdrawals and fees to confirm transparency

Following these steps ensures that your experience aligns with the promise in the title: evaluating how safe your money really is on Gracex.