Curious about Gracex Reviews 2025? Many traders wonder what lies behind the glossy ads. In this article, we dissect the broker’s services, accounts, platforms, and reputation, revealing what is genuine and what is marketing hype.

Who Gracex Is: A Broker Rewriting the Rules

Gracex positions itself as a modern broker that frees traders from outdated models. Traditional brokers often combine high spreads, hidden fees, and opaque execution. Gracex emphasizes technology, transparent conditions, and practical usability. Its mission is to simplify trading while maintaining professional-grade features, making it attractive for both beginners and active traders.

Traders looking into Gracex Reviews 2025 often highlight the focus on tech-driven execution as a distinguishing factor.

Account Types: Tailored for Every Trader

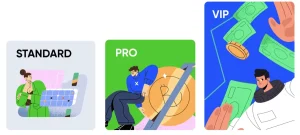

Gracex offers four main account types, each designed to meet different trading profiles:

- FREE — No minimum deposit, ideal for testing strategies. Spread starts at 1.2 pips.

- ZERO — Targeted at active traders; spreads from 0.00 pips, 0% commission on trades, no swaps. Entry threshold is moderate.

- FIX — Fixed spreads for traders preferring predictable costs. Useful in volatile markets.

- CENT — Allows micro trading with minimal risk, starting deposits under $10, ideal for beginners experimenting with strategies.

Reviewers frequently cite account flexibility and cost transparency as positive points in Gracex Reviews 2025.

Execution Model and Key Metrics

Gracex uses a pure STP (Straight Through Processing) model, without a dealing desk. This approach eliminates conflicts of interest between broker and trader, ensuring that client orders are processed directly to liquidity providers. Key metrics include:

- Spreads starting from 0.00 pips

- 0% trade commissions on selected accounts

- No swaps on many instruments

- Execution speed under 1 second on average

In the context of Gracex Reviews 2025, traders consistently praise the transparency and speed of order execution, especially on ZERO accounts.

Platform: MetaTrader 5

Gracex supports MetaTrader 5 across multiple devices: WebTrader for browser access, mobile apps for Android and iOS, and desktop software for Windows and Mac. Features include:

- Support for Expert Advisors (robots) and custom indicators

- Advanced charting and analytics

- Multiple order types and risk management tools

Traders in Gracex Reviews 2025 highlight MT5 as a stable and flexible platform, particularly for algorithmic and social trading.

Recognition and Regulation

Gracex received industry recognition in 2024 for growth and client support from reputable financial associations. Regulation is provided by GRACEXFX Ltd under license L15817/GL from the Union of Comoros (Anjouan). Client funds are segregated, and the broker adheres to international KYC/AML standards.

According to multiple sources cited in Gracex Reviews 2025, regulation and fund protection remain a recurring strength.

Markets and Trading Services

Gracex offers a wide range of tradable markets:

- Forex: majors and exotics

- Indices and commodities: metals and energy

- Crypto assets and regional CFDs sorted by continent

Services include Copy Trading for automatic trade replication, Social Trading to follow market trends, PAMM accounts for professional management, as well as welcome bonuses, educational content, and market analytics.

Feedback in Gracex Reviews 2025 frequently cites the diversity of services and educational support as notable advantages.

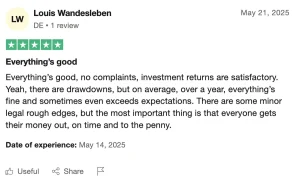

Reputation Breakdown: Strengths and Weaknesses

Based on forum posts, review sites, and social media, common strengths include:

- Fast and transparent execution

- Low or zero trading costs

- Flexible account types and platform stability

Recurring weaknesses noted by traders:

- Regulation is outside major financial hubs

- Limited physical office presence

- Occasional withdrawal delays in peak periods

Analyzing these factors helps create a balanced understanding of Gracex Reviews 2025.

Evaluation Criteria and Practical Insights

When assessing Gracex, consider three main criteria:

- Execution: STP model ensures no dealing desk interference; orders match liquidity pools directly.

- Platform Stability: MT5 consistently handles multiple positions without crashes; mobile app updates are timely.

- Fees: Transparent spreads and zero commissions on certain accounts reduce hidden costs.

Example: A trader using ZERO account on EUR/USD often experiences spreads near 0.0 pips, confirming advertised execution metrics.

Final Verdict: Gracex Reviews 2025

Is it true that Gracex lives up to the claims in its promotions? Based on account options, execution model, platform performance, and service breadth, the answer is yes, with caveats. While marketing may emphasize global licensing and rewards, the core strengths—fast STP execution, flexible accounts, and robust MT5 support—match trader experiences.

In conclusion, Gracex Reviews 2025 show that the broker delivers on key promises while certain marketing elements, such as global licensing prestige, are less critical to everyday trading. Traders looking for technology-driven, transparent execution and multi-market access will find Gracex a viable option.

Ultimately, this examination of Gracex Reviews 2025 separates verified performance from advertising, showing what turned out true and what remains marketing.